What you measure is what you get. Senior executives understand that their organization’s measurement system strongly affects the behavior of managers and employees. Executives also understand that traditional financial accounting measures like return-on-investment and earnings-per-share can give misleading signals for continuous improvement and innovation—activities today’s competitive environment demands. The traditional financial performance measures worked well for the industrial era, but they are out of step with the skills and competencies companies are trying to master today.

As managers and academic researchers have tried to remedy the inadequacies of current performance measurement systems, some have focused on making financial measures more relevant. Others have said, “Forget the financial measures. Improve operational measures like cycle time and defect rates; the financial results will follow.” But managers should not have to choose between financial and operational measures. In observing and working with many companies, we have found that senior executives do not rely on one set of measures to the exclusion of the other. They realize that no single measure can provide a clear performance target or focus attention on the critical areas of the business. Managers want a balanced presentation of both financial and operational measures.

During a year-long research project with 12 companies at the leading edge of performance measurement, we devised a “balanced scorecard”—a set of measures that gives top managers a fast but comprehensive view of the business. The balanced scorecard includes financial measures that tell the results of actions already taken. And it complements the financial measures with operational measures on customer satisfaction, internal processes, and the organization’s innovation and improvement activities—operational measures that are the drivers of future financial performance.

Think of the balanced scorecard as the dials and indicators in an airplane cockpit. For the complex task of navigating and flying an airplane, pilots need detailed information about many aspects of the flight. They need information on fuel, air speed, altitude, bearing, destination, and other indicators that summarize the current and predicted environment. Reliance on one instrument can be fatal. Similarly, the complexity of managing an organization today requires that managers be able to view performance in several areas simultaneously.

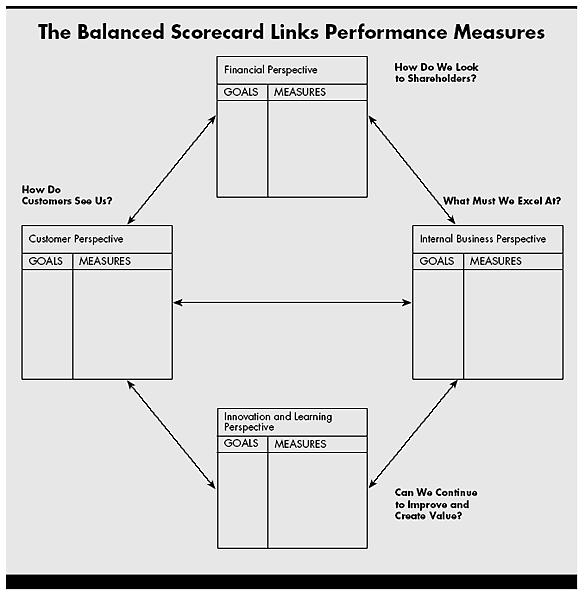

The balanced scorecard allows managers to look at the business from four important perspectives. (See the exhibit “The Balanced Scorecard Links Performance Measures.”) It provides answers to four basic questions:

How do customers see us? (customer perspective)

What must we excel at? (internal perspective)

Can we continue to improve and create value? (innovation and learning perspective)

How do we look to shareholders? (financial perspective)

While giving senior managers information from four different perspectives, the balanced scorecard minimizes information overload by limiting the number of measures used. Companies rarely suffer from having too few measures. More commonly, they keep adding new measures whenever an employee or a consultant makes a worthwhile suggestion. One manager described the proliferation of new measures at his company as its “kill another tree program.” The balanced scorecard forces managers to focus on the handful of measures that are most critical.

Several companies have already adopted the balanced scorecard. Their early experiences using the scorecard have demonstrated that it meets several managerial needs. First, the scorecard brings together, in a single management report, many of the seemingly disparate elements of a company’s competitive agenda: becoming customer oriented, shortening response time, improving quality, emphasizing teamwork, reducing new product launch times, and managing for the long term.

Second, the scorecard guards against suboptimization. By forcing senior managers to consider all the important operational measures together, the balanced scorecard lets them see whether improvement in one area may have been achieved at the expense of another. Even the best objective can be achieved badly. Companies can reduce time to market, for example, in two very different ways: by improving the management of new product introductions or by releasing only products that are incrementally different from existing products. Spending on setups can be cut either by reducing setup times or by increasing batch sizes. Similarly, production output and first-pass yields can rise, but the increases may be due to a shift in the product mix to more standard, easy-to-produce but lower-margin products.

We will illustrate how companies can create their own balanced scorecard with the experiences of one semiconductor company—let’s call it Electronic Circuits Inc. ECI saw the scorecard as a way to clarify, simplify, and then operationalize the vision at the top of the organization. The ECI scorecard was designed to focus the attention of its top executives on a short list of critical indicators of current and future performance.

Customer Perspective: How Do Customers See Us?

Many companies today have a corporate mission that focuses on the customer. “To be number one in delivering value to customers” is a typical mission statement. How a company is performing from its customers’ perspective has become, therefore, a priority for top management. The balanced scorecard demands that managers translate their general mission statement on customer service into specific measures that reflect the factors that really matter to customers.

Customers’ concerns tend to fall into four categories: time, quality, performance and service, and cost. Lead time measures the time required for the company to meet its customers’ needs. For existing products, lead time can be measured from the time the company receives an order to the time it actually delivers the product or service to the customer. For new products, lead time represents the time to market, or how long it takes to bring a new product from the product definition stage to the start of shipments. Quality measures the defect level of incoming products as perceived and measured by the customer. Quality could also measure on-time delivery, the accuracy of the company’s delivery forecasts. The combination of performance and service measures how the company’s products or services contribute to creating value for its customers.

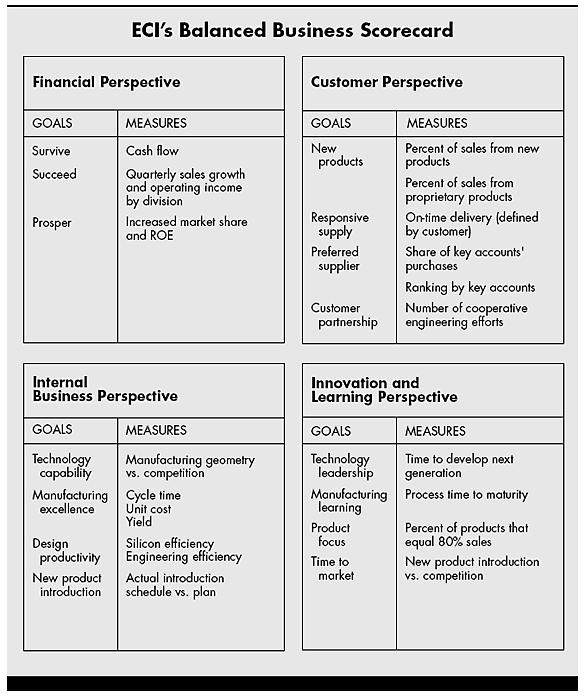

To put the balanced scorecard to work, companies should articulate goals for time, quality, and performance and service and then translate these goals into specific measures. Senior managers at ECI, for example, established general goals for customer performance: get standard products to market sooner, improve customers’ time to market, become customers’ supplier of choice through partnerships with them, and develop innovative products tailored to customer needs. The managers translated these general goals into four specific goals and identified an appropriate measure for each. (See the exhibit “ECI’s Balanced Scorecard.”)

To track the specific goal of providing a continuous stream of attractive solutions, ECI measured the percent of sales from new products and the percent of sales from proprietary products. That information was available internally. But certain other measures forced the company to get data from outside. To assess whether the company was achieving its goal of providing reliable, responsive supply, ECI turned to its customers. When it found that each customer defined “reliable, responsive supply” differently, ECI created a database of the factors as defined by each of its major customers. The shift to external measures of performance with customers led ECI to redefine “on time” so it matched customers’ expectations. Some customers defined “on-time” as any shipment that arrived within five days of scheduled delivery; others used a nine-day window. ECI itself had been using a seven-day window, which meant that the company was not satisfying some of its customers and overachieving at others. ECI also asked its top ten customers to rank the company as a supplier overall.

Depending on customers’ evaluations to define some of a company’s performance measures forces that company to view its performance through customers’ eyes. Some companies hire third parties to perform anonymous customer surveys, resulting in a customer-driven report card. The J.D. Powers quality survey, for example, has become the standard of performance for the automobile industry, while the Department of Transportation’s measurement of on-time arrivals and lost baggage provides external standards for airlines. Benchmarking procedures are yet another technique companies use to compare their performance against competitors’ best practice. Many companies have introduced “best of breed” comparison programs: the company looks to one industry to find, say, the best distribution system, to another industry for the lowest cost payroll process, and then forms a composite of those best practices to set objectives for its own performance.

In addition to measures of time, quality, and performance and service, companies must remain sensitive to the cost of their products. But customers see price as only one component of the cost they incur when dealing with their suppliers. Other supplier-driven costs range from ordering, scheduling delivery, and paying for the materials; to receiving, inspecting, handling, and storing the materials; to the scrap, rework, and obsolescence caused by the materials; and schedule disruptions (expediting and value of lost output) from incorrect deliveries. An excellent supplier may charge a higher unit price for products than other vendors but nonetheless be a lower cost supplier because it can deliver defect-free products in exactly the right quantities at exactly the right time directly to the production process and can minimize, through electronic data interchange, the administrative hassles of ordering, invoicing, and paying for materials.

Internal Business Perspective: What Must We Excel at?

Customer-based measures are important, but they must be translated into measures of what the company must do internally to meet its customers’ expectations. After all, excellent customer performance derives from processes, decisions, and actions occurring throughout an organization. Managers need to focus on those critical internal operations that enable them to satisfy customer needs. The second part of the balanced scorecard gives managers that internal perspective.

The internal measures for the balanced scorecard should stem from the business processes that have the greatest impact on customer satisfaction—factors that affect cycle time, quality, employee skills, and productivity, for example. Companies should also attempt to identify and measure their company’s core competencies, the critical technologies needed to ensure continued market leadership. Companies should decide what processes and competencies they must excel at and specify measures for each.

Managers at ECI determined that submicron technology capability was critical to its market position. They also decided that they had to focus on manufacturing excellence, design productivity, and new product introduction. The company developed operational measures for each of these four internal business goals.

To achieve goals on cycle time, quality, productivity, and cost, managers must devise measures that are influenced by employees’ actions. Since much of the action takes place at the department and workstation levels, managers need to decompose overall cycle time, quality, product, and cost measures to local levels. That way, the measures link top management’s judgment about key internal processes and competencies to the actions taken by individuals that affect overall corporate objectives. This linkage ensures that employees at lower levels in the organization have clear targets for actions, decisions, and improvement activities that will contribute to the company’s overall mission.

Information systems play an invaluable role in helping managers disaggregate the summary measures. When an unexpected signal appears on the balanced scorecard, executives can query their information system to find the source of the trouble. If the aggregate measure for on-time delivery is poor, for example, executives with a good information system can quickly look behind the aggregate measure until they can identify late deliveries, day by day, by a particular plant to an individual customer.

If the information system is unresponsive, however, it can be the Achilles’ heel of performance measurement. Managers at ECI are currently limited by the absence of such an operational information system. Their greatest concern is that the scorecard information is not timely; reports are generally a week behind the company’s routine management meetings, and the measures have yet to be linked to measures for managers and employees at lower levels of the organization. The company is in the process of developing a more responsive information system to eliminate this constraint.

Innovation and Learning Perspective: Can We Continue to Improve and Create Value?

The customer-based and internal business process measures on the balanced scorecard identify the parameters that the company considers most important for competitive success. But the targets for success keep changing. Intense global competition requires that companies make continual improvements to their existing products and processes and have the ability to introduce entirely new products with expanded capabilities.

A company’s ability to innovate, improve, and learn ties directly to the company’s value. That is, only through the ability to launch new products, create more value for customers, and improve operating efficiencies continually can a company penetrate new markets and increase revenues and margins—in short, grow and thereby increase shareholder value.

ECI’s innovation measures focus on the company’s ability to develop and introduce standard products rapidly, products that the company expects will form the bulk of its future sales. Its manufacturing improvement measure focuses on new products; the goal is to achieve stability in the manufacturing of new products rather than to improve manufacturing of existing products. Like many other companies, ECI uses the percent of sales from new products as one of its innovation and improvement measures. If sales from new products are trending downward, managers can explore whether problems have arisen in new product design or new product introduction.

In addition to measures on product and process innovation, some companies overlay specific improvement goals for their existing processes. For example, Analog Devices, a Massachusetts-based manufacturer of specialized semiconductors, expects managers to improve their customer and internal business process performance continuously. The company estimates specific rates of improvement for on-time delivery, cycle time, defect rate, and yield.

Other companies, like Milliken & Co., require that managers make improvements within a specific time period. Milliken did not want its “associates” (Milliken’s word for employees) to rest on their laurels after winning the Baldridge Award. Chairman and CEO Roger Milliken asked each plant to implement a “ten-four” improvement program: measures of process defects, missed deliveries, and scrap were to be reduced by a factor of ten over the next four years. These targets emphasize the role for continuous improvement in customer satisfaction and internal business processes.

Financial Perspective: How Do We Look to Shareholders?

Financial performance measures indicate whether the company’s strategy, implementation, and execution are contributing to bottom-line improvement. Typical financial goals have to do with profitability, growth, and shareholder value. ECI stated its financial goals simply: to survive, to succeed, and to prosper. Survival was measured by cash flow, success by quarterly sales growth and operating income by division, and prosperity by increased market share by segment and return on equity.

But given today’s business environment, should senior managers even look at the business from a financial perspective? Should they pay attention to short-term financial measures like quarterly sales and operating income? Many have criticized financial measures because of their well-documented inadequacies, their backward-looking focus, and their inability to reflect contemporary value-creating actions. Shareholder value analysis (SVA), which forecasts future cash flows and discounts them back to a rough estimate of current value, is an attempt to make financial analysis more forward looking. But SVA still is based on cash flow rather than on the activities and processes that drive cash flow.

Some critics go much further in their indictment of financial measures. They argue that the terms of competition have changed and that traditional financial measures do not improve customer satisfaction, quality, cycle time, and employee motivation. In their view, financial performance is the result of operational actions, and financial success should be the logical consequence of doing the fundamentals well. In other words, companies should stop navigating by financial measures. By making fundamental improvements in their operations, the financial numbers will take care of themselves, the argument goes.

Assertions that financial measures are unnecessary are incorrect for at least two reasons. A well-designed financial control system can actually enhance rather than inhibit an organization’s total quality management program. (See the insert, “How One Company Used a Daily Financial Report to Improve Quality.”) More important, however, the alleged linkage between improved operating performance and financial success is actually quite tenuous and uncertain. Let us demonstrate rather than argue this point.

Over the three-year period between 1987 and 1990, a NYSE electronics company made an order-of-magnitude improvement in quality and on-time delivery performance. Outgoing defect rate dropped from 500 parts per million to 50, on-time delivery improved from 70 % to 96 % and yield jumped from 26 % to 51 % . Did these breakthrough improvements in quality, productivity, and customer service provide substantial benefits to the company? Unfortunately not. During the same three-year period, the company’s financial results showed little improvement, and its stock price plummeted to one-third of its July 1987 value. The considerable improvements in manufacturing capabilities had not been translated into increased profitability. Slow releases of new products and a failure to expand marketing to new and perhaps more demanding customers prevented the company from realizing the benefits of its manufacturing achievements. The operational achievements were real, but the company had failed to capitalize on them.

The disparity between improved operational performance and disappointing financial measures creates frustration for senior executives. This frustration is often vented at nameless Wall Street analysts who allegedly cannot see past quarterly blips in financial performance to the underlying long-term values these executives sincerely believe they are creating in their organizations. But the hard truth is that if improved performance fails to be reflected in the bottom line, executives should reexamine the basic assumptions of their strategy and mission. Not all long-term strategies are profitable strategies.

Measures of customer satisfaction, internal business performance, and innovation and improvement are derived from the company’s particular view of the world and its perspective on key success factors. But that view is not necessarily correct. Even an excellent set of balanced scorecard measures does not guarantee a winning strategy. The balanced scorecard can only translate a company’s strategy into specific measurable objectives. A failure to convert improved operational performance, as measured in the scorecard, into improved financial performance should send executives back to their drawing boards to rethink the company’s strategy or its implementation plans.

As one example, disappointing financial measures sometimes occur because companies don’t follow up their operational improvements with another round of actions. Quality and cycle-time improvements can create excess capacity. Managers should be prepared to either put the excess capacity to work or else get rid of it. The excess capacity must be either used by boosting revenues or eliminated by reducing expenses if operational improvements are to be brought down to the bottom line.

As companies improve their quality and response time, they eliminate the need to build, inspect, and rework out-of-conformance products or to reschedule and expedite delayed orders. Eliminating these tasks means that some of the people who perform them are no longer needed. Companies are understandably reluctant to lay off employees, especially since the employees may have been the source of the ideas that produced the higher quality and reduced cycle time. Layoffs are a poor reward for past improvement and can damage the morale of remaining workers, curtailing further improvement. But companies will not realize all the financial benefits of their improvements until their employees and facilities are working to capacity—or the companies confront the pain of downsizing to eliminate the expenses of the newly created excess capacity.

If executives fully understood the consequences of their quality and cycle-time improvement programs, they might be more aggressive about using the newly created capacity. To capitalize on this self-created new capacity, however, companies must expand sales to existing customers, market existing products to entirely new customers (who are now accessible because of the improved quality and delivery performance), and increase the flow of new products to the market. These actions can generate added revenues with only modest increases in operating expenses. If marketing and sales and R&D do not generate the increased volume, the operating improvements will stand as excess capacity, redundancy, and untapped capabilities. Periodic financial statements remind executives that improved quality, response time, productivity, or new products benefit the company only when they are translated into improved sales and market share, reduced operating expenses, or higher asset turnover.

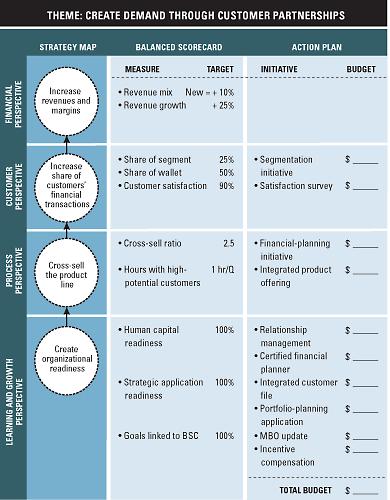

Ideally, companies should specify how improvements in quality, cycle time, quoted lead times, delivery, and new product introduction will lead to higher market share, operating margins, and asset turnover or to reduced operating expenses. The challenge is to learn how to make such explicit linkage between operations and finance. Exploring the complex dynamics will likely require simulation and cost modeling.

Measures that Move Companies Forward

As companies have applied the balanced scorecard, we have begun to recognize that the scorecard represents a fundamental change in the underlying assumptions about performance measurement. As the controllers and finance vice presidents involved in the research project took the concept back to their organizations, the project participants found that they could not implement the balanced scorecard without the involvement of the senior managers who have the most complete picture of the company’s vision and priorities. This was revealing because most existing performance measurement systems have been designed and overseen by financial experts. Rarely do controllers need to have senior managers so heavily involved.

Probably because traditional measurement systems have sprung from the finance function, the systems have a control bias. That is, traditional performance measurement systems specify the particular actions they want employees to take and then measure to see whether the employees have in fact taken those actions. In that way, the systems try to control behavior. Such measurement systems fit with the engineering mentality of the Industrial Age.

The balanced scorecard, on the other hand, is well suited to the kind of organization many companies are trying to become. The scorecard puts strategy and vision, not control, at the center. It establishes goals but assumes that people will adopt whatever behaviors and take whatever actions are necessary to arrive at those goals. The measures are designed to pull people toward the overall vision. Senior managers may know what the end result should be, but they cannot tell employees exactly how to achieve that result, if only because the conditions in which employees operate are constantly changing.

This new approach to performance measurement is consistent with the initiatives under way in many companies: cross-functional integration, customer-supplier partnerships, global scale, continuous improvement, and team rather than individual accountability. By combining the financial, customer, internal process and innovation, and organizational learning perspectives, the balanced scorecard helps managers understand, at least implicitly, many interrelationships. This understanding can help managers transcend traditional notions about functional barriers and ultimately lead to improved decision making and problem solving. The balanced scorecard keeps companies looking—and moving—forward instead of backward.

Post a Comment